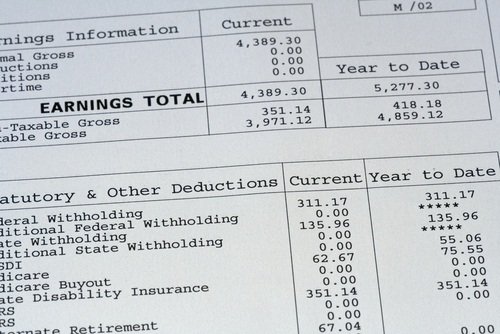

Nevada wage and hour law requires employers to give employees an itemized list of deductions with every pay stub. Employees may also request that employers produce their “record of wages,” which includes:

- deductions

- gross pay

- net cash wage/ salary

- date of payment

- total hours worked (unless an exemption applies)

If an employer fails to provide pay stubs and records to their employees, the employees can file a general employment complaint with the Nevada Labor Commissioner or even sue. The employer would also face a $5,000 administrative fine as well as criminal misdemeanor charges.

In this article, our Las Vegas Nevada labor law attorneys discuss:

1. Nevada pay stub laws

Nevada law requires employers to give their employees an itemized list along with their paycheck that shows all the deductions made from the employee’s wages. These deductions typically include:

- federal income tax

- social security tax

- medicare tax

- medical insurance (if applicable)

- 401K plans (if applicable)

(If the employee receives payment through direct deposit, the employer may mail or otherwise transmit this itemized list to the employee separate from the paycheck.)1

Employees can also make a written request to their employers for a “record of wages.” This is a statement for each pay period that shows deductions as well as the following four pieces of information:

- gross pay not including compensation for services, food, housing, or clothing;

- net cash wage or salary

- date of payment

- total hours employed in the pay period by noting the number of hours per day (with certain exceptions, including certain domestic service employees)

Employers must provide these records of wages to their employees within 10 days of the employee requesting it. Note that employers are required to maintain employees’ records of wages for two (2) full years.2

2. Nevada pay stub violations

Employers who do not provide their employees with an itemized list (with each paycheck) or a record of wages (upon request) face misdemeanor charges. (See the previous section for more information about what constitutes itemized lists and records of wages.)

Nevada misdemeanor penalties include:

- up to six (6) months in jail, and/or

- up to $1,000 in fines

In addition, the Nevada Labor Commissioner may impose an administrative penalty on the employer of up to $5,000 for each violation.

3. Suing an employer for Nevada pay stub violations

If an employer neglects — or refuses — to provide employees with their itemized statements or records of wages, the employee may file a lawsuit against the employer. If successful, the judge could then order the employer to produce the necessary documents.

Note that it is often unnecessary to resort to lawsuits in order to obtain pay stub information. Instead, the employee can file a general employment complaint with the Nevada Labor Commissioner:

These complaints can be filled out and submitted online. The Labor Commissioner would then investigate the matter and possibly contact the employer in an effort to get the documents. Depending on the case, the Commissioner may hold a hearing — similar to a trial — and can issue a binding decision that can be enforced in courts.3

Note that there is a two (2) years statute of limitations to file a complaint with the Labor Commissioner.4

4. Correcting pay stub errors in Nevada

If an itemized list or record of wages contains inaccuracies, the employee is advised to inform the employer as soon as possible. If the employer refuses to correct the information, then the employee can consider filing a complaint with the Nevada Labor Commissioner (see the previous section for more information).

Call a Nevada labor law attorney…

Is your boss in Nevada refusing to give you your pay stub? Call our Las Vegas employment law attorneys. We can help you file a complaint with the Labor Commissioner and try to recover any unpaid wages you may be owed.

If you have been charged with a pay stub violation in Nevada, call our Las Vegas criminal defense attorneys. We may be able to get the charge reduced or dismissed so you can go back to running your business.

Work in California? See our article on California pay stub violations.

Legal References

- NRS 608.110 Withholding of portion of wages.1. This chapter does not preclude the withholding from the wages or compensation of any employee of any dues, rates or assessments becoming due to any hospital association or to any relief, savings or other department or association maintained by the employer or employees for the benefit of the employees, or other deductions authorized by written order of an employee.2. At the time of payment of wages or compensation, the employer shall furnish the employee with an itemized list showing the respective deductions made from the total amount of wages or compensation.3. Except as otherwise provided by an agreement between the employer and employee, any employer who withholds money from the wages or compensation of an employee for deposit in a financial institution shall deposit the money in the designated financial institution within 5 working days after the day on which the wages or compensation from which it was withheld is paid to the employee.NAC 608.135 Notice of regular paydays and place of payment; electronic payment. (NRS 607.160, 608.080, 608.120)1. In addition to the information required pursuant to NRS 608.080, the notice described in NRS 608.080 may /include:

(a) Alternative paydays for use if a regular payday occurs on a nonbusiness day, including a Saturday, Sunday or holiday;

(b) Acceptable alternatives to the method of payment if an employee is not available for payment;

(c) Procedures for releasing payment to a third party; and

(d) Any other provision that the employer deems to be relevant if the provision does not violate any law or regulation of this State.

2. An employer may use an electronic payment system, including, but not limited to, a direct deposit, debit card or similar payment system, as an alternative location of payment if:

(a) The employee can obtain immediate payment in full;

(b) The employee receives at least one free transaction per pay period and any fees or other charges are prominently disclosed to and subject to the written consent of the employee;

(c) The alternative location of payment is easily and readily accessible to the employee;

(d) There are no other requirements or restrictions that a reasonable person would find to be an unreasonable burden or inconvenience; and

(e) The use of an electronic payment system is optional at the election of the employee.

NRS 608.120 Manner of payment of wages. The payment of wages or compensation must be made in lawful money of the United States or by a good and valuable negotiable check or draft drawn only to the order of the employee unless:

1. The employee has agreed in writing to some other disposition of his or her wages; or

2. The employer has been directed to make some other disposition of the employee’s wages by:

(a) A court of competent jurisdiction; or

(b) An agency of federal, state or local government with jurisdiction to issue such directives.

–> Such checks or drafts must be payable on presentation thereof at some bank, credit union or established place of business without discount in lawful money of the United States. They must be payable at the place designated in the notice prescribed in NRS 608.080.

- NRS 608.115 Records of wages.1. Every employer shall establish and maintain records of wages for the benefit of his or her employees, showing for each pay period the following information for each employee:(a) Gross wage or salary other than compensation in the form of:(1) Services; or(2) Food, housing or clothing.(b) Deductions.

(c) Net cash wage or salary.

(d) Except as otherwise provided in NRS 608.215, total hours employed in the pay period by noting the number of hours per day.

(e) Date of payment.

2. The information required by this section must be furnished to each employee within 10 days after the employee submits a request.

3. Records of wages must be maintained for a 2-year period following the entry of information in the record.

NAC 608.140 Provision of records of wages to employee. (NRS 607.160, 608.115) Within 10 days after a request by an employee, an employer shall provide the records of wages required to be kept by the employer pursuant to NRS 608.115 to the employee, including, but not limited to, an employee that is paid by salary, piece rate or any other wage rate.

- NRS 608.195 Criminal and administrative penalties.1. Except as otherwise provided in NRS 608.0165, any person who violates any provision of NRS 608.005 to 608.195, inclusive, or 608.215, or any regulation adopted pursuant thereto, is guilty of a misdemeanor.2. In addition to any other remedy or penalty, the Labor Commissioner may impose against the person an administrative penalty of not more than $5,000 for each such violation

- See Forms for Employees, State of Nevada Department of Business & Industry Office of the Labor Commissioner.