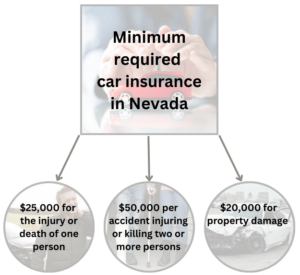

Bodily injury liability insurance covers physical injuries to other people when you are at fault for causing a car accident. Nevada law requires all vehicle owners to carry a minimum amount of bodily injury coverage of:

- $25,000 for the injury or death of one person, and

- $50,000 for the injury or death or two or more people.

You must carry a policy for every car, motorcycle, truck, or SUV you have registered in Nevada, even if you do not drive them often.

Bodily injury liability insurance does not cover the insured driver’s own injuries, regardless of who is at fault for an accident (many drivers carry MedPay to cover their own injuries). Nor does it cover damage to vehicles or other property damage (“collision coverage”).

The following chart compares and contrasts the different types of automobile insurance available in Nevada.

| Insurance Type in Nevada | What it Covers | Required or Optional | At-Fault Party | Coverage |

| Bodily injury or death | Injuries or death of people in the other vehicle | Required | You | At least $25,000 per person, $50,000 per accident |

| Injury to or destruction of property | Damage to the other vehicle or property | Required | You | At least $20,000 |

| MedPay | Your injuries and your passengers’ injuries | Optional | Regardless of fault | At least $1,000 |

| Uninsured/Underinsured motorist (UM/UIM) |

Your injuries and your passengers’ injuries if the other driver has little or no insurance or commits hit-and-run | Optional | Other driver | At least $25,000 per person, $50,000 per accident |

| Collision | Damage to your vehicle | Optional | Regardless of fault | Up to your car’s actual cash value |

| Comprehensive | Damage to your vehicle from theft, road hazards, weather, etc. | Optional | Regardless of fault | Up to your car’s actual cash value |

Below our Nevada personal injury lawyers discuss:

- 1. What is bodily injury liability insurance?

- 2. Whom does it protect?

- 3. What expenses does it cover?

- 4. Will it pay for my medical bills after a car accident?

- 5. How much bodily injury insurance must I carry in Nevada?

- 6. What if I do not have enough insurance?

- 7. What if more than one person is injured?

- 8. What if I am only partially at fault?

- 9. How much does bodily injury liability insurance cost?

- 10. What if I do not have insurance?

- 11. Does Nevada offer PIP insurance?

- Additional Reading

1. What is bodily injury liability insurance?

Bodily injury liability insurance is part of a standard auto insurance policy. It covers injuries to other drivers, passengers and pedestrians in the event of an accident where:

- other people suffer bodily injury and

- the insured is at fault.

Bodily liability limits are represented by two numbers:

- The first number represents the limit for damages to any one person injured in an accident.

- The second number represents the maximum amount that will be paid to all people injured in any one accident (sometimes referred to as the “per occurrence” limit).

For instance, if you carry Nevada’s minimum of 25/50 bodily injury liability coverage, your insurer will pay:

- a maximum of $25,000 to any one person and

- a maximum of $50,000 in total to all people injured in the accident.

Often you will see a third number in a listing of Nevada auto insurance (for instance 25/50/20). The third number represents property damage liability insurance. This coverage applies to damages you cause to another person’s car or other property.

Bodily injury liability insurance kicks in if you are at fault for the car accident.

2. Whom does it protect?

If you cause a car accident, bodily liability insurance protects you from injury claims brought by:

- Other drivers,

- Passengers in other vehicles,

- Passengers in your own vehicle, and

- Pedestrians and bystanders.

Your insurer will also defend you against claims if it believes you were not at fault.

3. What expenses does it cover?

Bodily injury insurance applies to all damages arising from physical injuries to other people, not just medical bills like ambulance rides, hospital stays, or rehabilitation. Bodily injury insurance also covers the victims’:

- Lost wages,

- Lost earning capacity / future earnings,

- Pain and suffering, and

- Funeral expenses (in cases of wrongful death).

4. Will it pay for my medical bills after a car accident?

Bodily injury liability insurance does not cover your own medical bills. For that, you will need to purchase optional MedPay or Uninsured Motorist Coverage or have another source of medical bill payments such as personal health insurance or Medicare.

5. How much bodily injury insurance must I carry in Nevada?

Under Nevada’s insurance requirements, drivers must carry a minimum of 25/50 bodily injury liability insurance for their vehicles registered in the state.

In many cases, however, these limits are not high enough to cover all of the other party’s damages from an accident.

If damages to the other party exceed these limits, the insured driver is personally on the hook to pay the balance.

Example: Veronica runs a red light and gets into an accident with a motorcycle in Las Vegas. The motorcyclist claims compensatory damages totaling $35,000. However, Veronica’s insurance covers only $25,000 in bodily injury. Veronica’s insurer pays out $25,000, and the motorcyclist sues Veronica for the other $10,000.

An insurance agent can help you find the best rates. Remember you must always drive with proof of insurance.

In Nevada, drivers must carry a minimum of $25,000 of bodily injury liability insurance for one person and a minimum of $50,000 per accident.

6. What if I do not have enough insurance?

If you do not have enough insurance to cover the other party’s damages, the other party or parties can sue you personally for the excess. It may be a good idea, therefore, to purchase higher policy limits if you can afford them – particularly if you have assets you wish to protect.

Example: One night Pete rear-ends Rhonda’s car, causing her a serious spinal injury. Rhonda claims compensatory damages of $45,000. However, Pete’s insurance will only cover $25,000. Rhonda can then sue Pete personally for the extra $20,000, rely on her own medical insurer, or use her own under-insured motorist coverage.

7. What if more than one person is injured?

If you injure more than one person and have insufficient auto insurance coverage, your bodily liability coverage will be divided up proportionately based on the other parties’ total damages.

The more people are involved, the less likely your insurance will cover everyone’s damages. Therefore, they may try to sue you for the difference.

8. What if I am only partially at fault?

Nevada law allows victims who are partially to blame for a car accident to recover financial damages if they were no more than 50% at fault. However, the court will reduce their damages award by their proportion of fault.

So for example if you sustain $10,000 worth of damages in an accident you were 50% at fault for – and the case goes to trial – the court would award you only $5,000.

For more information, please see our article on Nevada’s comparative negligence (shared fault) law.

9. How much does bodily injury liability insurance cost?

It depends on many factors, such as:

- your age – teens and the elderly tend to have higher premiums

- your driving history – the more accidents and infractions, the higher your rates

- your vehicle – the more it costs to repair or less safe it is, and higher your insurance

Several other variables play in as well, such as your zip code, credit score, marital status, etc. Plus of course, the more coverage you purchase, the more it costs.

Therefore, insurance can cost a few hundred to a few thousand dollars a year depending on your situation.

10. What if I do not have insurance?

Not carrying the required liability insurance for your car is a misdemeanor in Nevada under NRS 485.187. The penalties include $600 to $1,000 in fines. However, the fine for a first-time violation typically gets reduced to $100 if you obtain a policy by your sentencing date.

11. Does Nevada offer PIP insurance?

No. PIP (Personal Injury Protection) insurance covers medical expenses and lost wages regardless of fault in an accident. Since Nevada is a fault-based state, PIP insurance is unavailable here.

Instead, Nevada uses a fault-based system where the at-fault driver’s insurance covers damages. The fault-based equivalent to PIP in Nevada is MedPay coverage, which can help pay for medical expenses after an accident regardless of fault. However, MedPay is typically more limited than PIP.

Additional Reading

For more information, see our related articles:

- How to get your “car repair bills” paid after a Nevada accident – Guide on making the most of your collision coverage.

- How to get your “medical bills” paid after a Nevada accident or injury – Your options on getting your doctor’s bills covered.

- How to file a car insurance claim after an accident in Nevada – Step-by-step guide on dealing with insurance.

- How uninsured motorist insurance and underinsured motorist insurance (UM / UIM) works in Nevada – Explainer re. why UM/UIM is so important to carry, especially since approximately 15% of drivers carry no insurance.

- How “MedPay” car insurance works in Nevada – The pros of carrying MedPay if you are able.