In Nevada, a structured settlement in a personal injury case is an amount paid to you over a period of time, rather than all at once.

Lump-sum payments are the most common form of settlement in a Nevada injury case. Though under certain circumstances – particularly when the dollar amount of the settlement is very high – the defendant may offer a structured settlement.

In most cases, you should seek a lump-sum payments over periodic payments. However, a structured settlement can be advantageous when:

- You are very young or unable to manage your own finances,

- There are tax advantages to deferring all or part of the money, or

- The defendant offers a larger sum of money if paid overtime.

To help you better understand how structured settlements work in a Nevada injury case, our Nevada personal injury lawyers discuss the following, below:

- 1. What is a structured settlement?

- 2. When is it used in Nevada?

- 3. How does it work?

- 4. What are the advantages?

- 5. How do I protect payments under a structured settlement?

- Additional reading

Most plaintiffs in personal injury cases prefer lump-sum settlements over structured settlements.

1. What is a structured settlement?

A structured settlement is when the defendant agrees to pay you a sum over a period of time rather than one lump sum upfront.

Structured settlements must be negotiated. Standard terms include:

- Whether the structured settlement payments are to be paid directly by the defendant or deposited with a third party (such as a life insurance company);

- The period of time over which money is to be paid;

- How often the money is to be paid (such as once a year, semi-annually, monthly, etc.);

- How much is to be paid on each payment date;

- Whether the settlement will include a lump sum payment at either the beginning or the end of the term;

- Whether payments continue to your heirs if you die before the full sum has been paid out; and

- Whether the party making or receiving the payments can (subject to applicable law) transfer its rights or obligations under the agreement.1

2. When is it used in Nevada?

Structured settlements are typically used in Nevada injury cases in three situations:

- When the defendant does not have enough money to make a lump sum payment now;

- When there are tax advantages to deferring some of the payment; or

- When you are unable to manage your finances for any reason, such as:

-

- The injuries have left you seriously disabled,

- You are financially irresponsible,

- You are very young, or

- There is concern that you or your family will not manage the settlement responsibly.

Structured settlements are also common when you are a minor child and the settlement is reached by way of compromise of the minor’s claim.

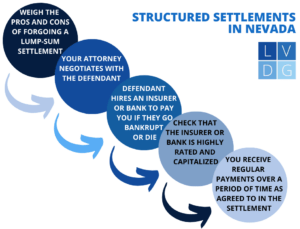

3. How does it work?

There is no set way a Nevada structured settlement must work. Most, however, involve either:

- A specified number of set payments over a period of time, or

- A set payment made at a regular date for the lifetime of you or until all the money has been paid (a structured settlement annuity).

Structured settlements may be advantageous to plaintiffs who struggle with money management.

Example: Vanessa suffers a permanent brain injury after an accident with a commercial vehicle. Her total compensatory damages are over $6.5 million. The driver’s employer has commercial auto insurance with a total limit of $3,000,000.

The insurer and employer agree either to pay Vanessa a lump-sum payment of $3,000,000 under the policy, or she can accept a structured settlement that will pay her $1,000,000 now, plus $100,000 per year for the rest of her life.

4. What are the advantages?

In some cases, it can be advantageous to postpone all or part of a settlement payment, particularly if any portion is taxable as income.

Example: Carl negligently starts a fire that burns much of Danielle’s store next door. Her business losses are $1,300,000, but Carl’s insurance limit is only $1,000,000.

Danielle accepts a $1,000,000 immediate payment from Carl’s insurance, and Carl will pay Danielle another $25,000 per year for the next 20 years. Even though this is less money than Danielle might be able to get by suing Carl, most of the balance is taxable as lost business income, so Danielle is able to pay tax on it in later years.

Another potential advantage of a structured settlement is that it offers protection if you are not good with money management. A structured settlement guards against you spending everything quickly and having nothing coming in later.

The advantage of a lump-sum payment is you get the money now and do not have to worry that the defendant may cease to exist or become insolvent.

5. How do I protect payments under a structured settlement?

If a company is well-capitalized and has been in business a long time, accepting payments over time may be fairly safe. However, if the company declares bankruptcy or otherwise goes out of business, you may lose any payments that have not yet been made.

To protect against this, a defendant will sometimes agree to pay a sum of money over to a life insurer or another financial institution on your behalf. The money will then be paid out as an annuity. For the reasons set forth above, it is important to make sure the company chosen is highly rated and capitalized in order to avoid scams or having to hire a debt collector.

Additionally, you should be aware that the defendant’s insurer or lawyer often drafts structured settlement agreements. These agreements will almost always be weighted in favor of the defendant’s interests.

Before agreeing to a structured settlement, it is highly recommended you retain an experienced Las Vegas personal injury lawyer to review and negotiate the agreement on your behalf.2

Additional reading

For more in-depth information, refer to these scholarly articles:

- Enforcing and Reforming Structured Settlement Protection Acts: How the Law Should Protect Tort Victims – Columbia Law Review.

- Structured Settlements: The Assignability Problem – California Interdisciplinary Law Journal.

- Structured Settlements: Customized Compensation for Personal Injury Plaintiffs – Stetson Law Journal.

- The Structured Judgment as an Alternative to Caps on Personal Injury Damages – Northern Kentucky Law Review.

- Negotiating a Structured Settlement – A.B.A. Journal.

Legal references:

- See, for example, NRS 42.030 on when the transfer of a structured settlement must be approved by a court.

- See also General Motors Corp. v. Reagle, (1986) 102 Nev. 8, 714 P.2d 176 (“In order to allow full recovery, it is necessary to reduce the verdict by only the present value of the structured settlement package.“); see also Marquis & Aurbach v. Eighth Judicial Dist. Court, (2006) 122 Nev. 1147, 146 P.3d 1130.